Tata Motors Full Analysis, Share Price Target 2025, 2026, 2030:-Indian leading car maker Tata Motors has given a massive return to their investor in the past 3 years. After COVID-19 company share price dropped down to as low as 80 rupees and then reached the 1100 + mark in September 2024. As Foreign Investors continue to sell their holding in the Indian market, many good stocks Fall up to 50 %.

In October and November month Indian stock market as corrected more than 30 %. Many companies’ Q2 profit has declined from 10 to 20%. The latest news which is coming from a source said that Tata Motors net profit was down to 3450 crore which was 5692 crore in the previous quarter. Low Sales during festival season and high taxes is also a reason of such low sales.

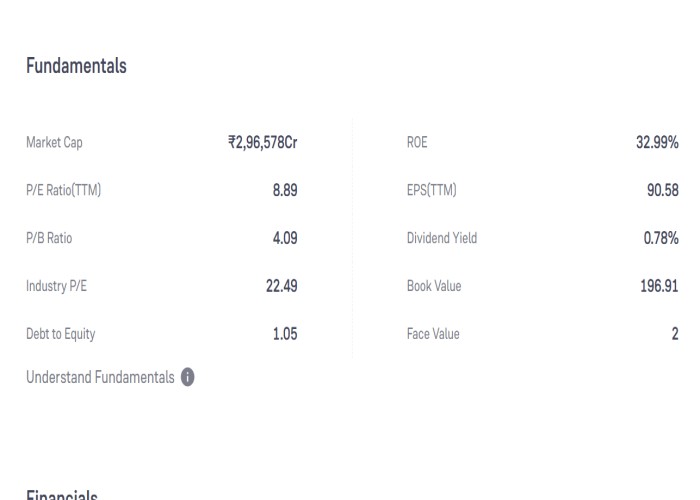

Tata Motors Fundamentals Analysis

Tata Group has achieved milestones in the previous few decades. Back in 2003, Tata Group launched Indica from that time to till date tata has never disappointed its Customers. At present Tata Motors market cap is 2,96,578 crores.

The company has a good return on Equity (ROE) of more than 36.5 %. At the time of October Market crash, the PE Ratio of Tata Motors was 8.89 which is also considered a good PE. In the last 5 years, the company has delivered 93.5 % CAGR to its shareholders. As Tata is expanding its ev business globally so company’s future will also be good

Pros :-

- Company is almost debt free.

- Last 5 Year ROE is more than 30 %

- Tata motors Expending it’s EV segment.

Cons:-

- September Profit decline.

- Promoter Sold 3.78% stake in the company

Tata Motors Share Price Target Chart 2026, 2030

| Price | Month |

| January 2025 | 850 to 870 |

| February 2025 | 875 to 890 |

| March 2025 | 900 to 915 |

| April 2025 | 920 to 930 |

| May 2025 | 932 to 945 |

| June 2025 | 950 to 962 |

| July 2025 | 965 to 980 |

| August 2025 | 982 to 995 |

| September 2025 | 998 to 1015 |

| October 2025 | 1020 to 1035 |

| November 2025 | 1040 to 1065 |

| December 2025 | 1070 to 1100 |

Tata Motors Share Price Chart Target Year Wise

| Price | Year |

| 2025 | 850 to 1180 |

| 2026 | 1190 to 1580 |

| 2027 | 1590 to 1850 |

| 2028 | 1860 to 2350 |

| 2029 | 2360 to 2750 |

| 2030 | 2760 to 3150 |

Is it Good to Buy Tata Motors Now

In this bear run most people want to Know when will be the right time to buy Tata Motors, As per few analysts end of 2024 surely be the right time. Few stocks are totally suitable to buy for a long time and Tata Motors is also one of them. By 2030 India’s Automobile sector will have a massive growth due to Electric Vehicle.

According to brokerage firm Motilal Oswal Tata Motors’ Future is bright and for long-term investor it is surely a right time to buy.

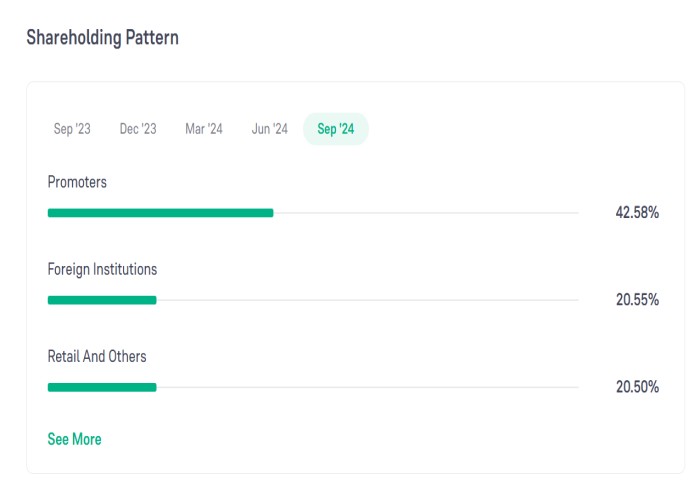

Shareholding Pattern of Tata Motors

Usually, Promotors, FII & DII holding are considered a good sign for any company. In the market crash time FII Holding in Tata Motors; has increased. Promotors and Mutual fund holding is also good as of September 2024. Last year in September 2023 holding of FII Was about 18.66 % which has been increased to 20.55. Many popular Mutual funds still hold a good amount in the company.

The only thing that makes some investors worried is that the Promoter Slowly Sold out about 3 % shares in this quarter. One popular investor i.e Rakesh Jhunjhunwala’s wife also Holds around 1.3% share of Tata Motors. I hope you like the article for more update Keep in touch with our homepage.