KRN Heat Exchanger:- The Indian stock market has been growing fast for the past few years, Each month many company’s IPO have been listed, Recently in September a mega company named KRN Heat Exchanger was listed in the stock market. Talk about the company product and profile, The Company is established in the year 2017 in Rajasthan and specializes in the manufacturing and export of Coils, condenser fans, heat exchangers,

Company growth is good over the past few years. In this short time company profit growth touch the milestone. In the annual report chart it is clear that company’s annual growth and revenue growth is more than 30 % which is a good sign.

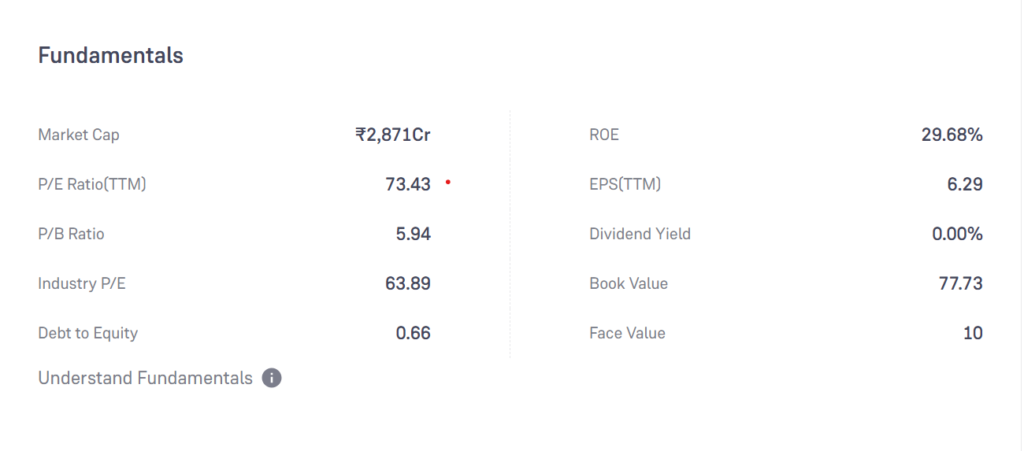

KRN Heat exchanger Fundamentals

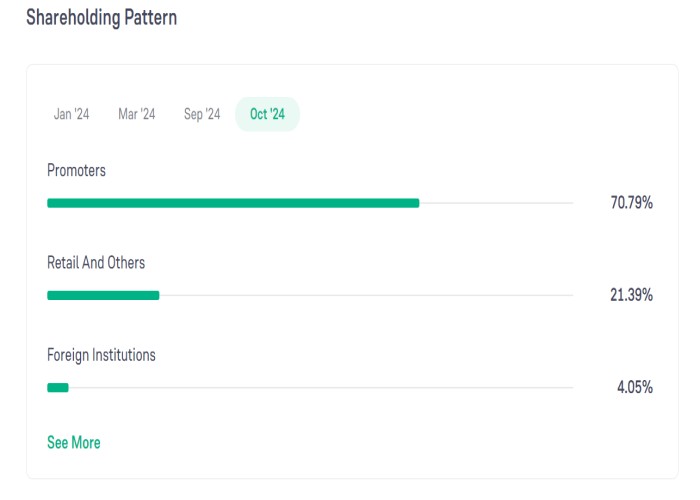

Regarding the graphs and fundamentals, KRN Heat exchange valuation as per NSE is around 2869 crore, which is an average compared to other companies. Regarding other fundamentals, As of September 2024, the PE Ratio is around 73,37. the company claimed a net revenue of 314 Crore in 2024 and a net profit of 39.07 crore. Promotor holding currently is about 70 % in the company and Domestic institutions and foreign institutions also invested in the company which is a Positive sign,

Pros

- Return of Equity of past three years is more than 40 which is Good

- Company net Gross margin is High

- Promotor holding is more than 70 %

- Company offering service to Big brands like Voltas, Deccan, Blue Star

Cons :-

- Company has Only one manufacturing Unit

- Valuation of Company is little Higher

- company has domestic operations.

Share Holding Pattern KRN Heat exchanger

From the start, the company’s fundamentals were very good. Currently, promoter holding is about 70 %, foreign institutions hold around 4.05 %, and Mutual funds hold is also 1.83 %. In the next quarter it will be interesting to Know How much holding DII and FII increased for this company. If the numbers are positive then stock price may continue to increase. Those who are looking for good returns in the company have to wait for 2 to 3 years.

KRN Heat Exchanger Share Price target

| Year | Price |

| October 2024 | 478 to 490 |

| November 2024 | 495 to 740 |

| December 2024 | 740 to 810 |

| January 2025 | 810 to 825 |

| February 2025 | 825 to 840 |

| Year | Price |

| 2024 | 480 to 810 |

| 2025 | 810 to 990 |

| 2026 | 995 to 1150 |

| 2027 | 1150 to 1230 |

| 2028 | 1240 to 1340 |

| 2029 | 1345 to 1500 |

| 2030 | 1510 to 1650 |

After seeing the financials it is clear that the company’s ROE and P/E Ratio is good. It is the best time if you want to Invest in this stock, White Oak Capital, and Bandhan Small Fund is currently the two top mutual fund that have invested in this stock. You can also wait for next quarter so that if mutual funds holding increase this will be a good sign for retail invest as well.