Garuda Construction & Engineering:- As the Indian infrastructure is at its peak, many new companies are filing their DHP to SEBI. Another new company these days is Garuda Construction, whose IPO was just announced in mid-October. Due to its popularity, the company IPO was Subscribed 7 times which showed an overwhelming response from the Public.

As per the reports of Live Mint, it is clear that in 3 days of bidding, the company received 15 crore shares against a 1.8 crore offer, The Estimated Value of the IPO Was 264 Crore During the IPO, a few analysts Said that it was recommended to apply for an IPO this time. However, the company was only able to gain 10% gain after listing on NSE & BSE.

Garuda Construction Company Goals & Growth Plans

As Per their official Source, the Company mainly focuses on Residential and Commercial-scale Construction. The company was established in 2010 In Maharashtra and to date company’s Profit and business is stable. Now to boost the upcoming project company offers a 1.8 Crore equity share again 264 crore Value.

In the last 10 Years company has provided Valuable residential apartments to their customer, Business and Commercial parks are also the company’s main focus, Apart from the construction, the company is also in the business of maintenance and Plumbing service in Residential areas. To date company’s net profit was about 40 crore in the year 2023, However, net profit after tax declined a bit in the year 2024 which is 36 crore.

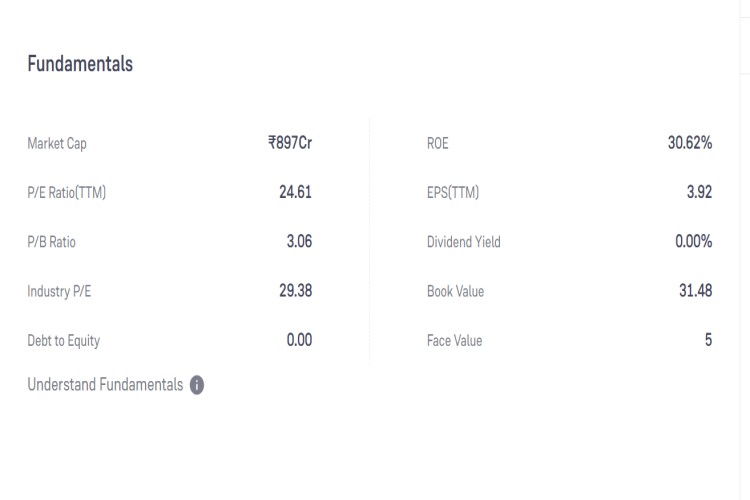

Company Fundamentals Analysis

Before investing in any stock people want a complete fundamental company analysis. Well, the Above Overview already gave you an idea of what the business company is doing and a Good response from an IPO is also a positive sign for the company. As of October 2024, the Company’s market cap is around 980 Crore,

The company’s major focus is on residential, so no such big project details are available. You can say that the company is a small cap, and if the company gets a big project in the upcoming days, then there are high chances that the stock may go up.

Pros:- During the fundamental analysis it is observed that few points which may make you to invest in the company

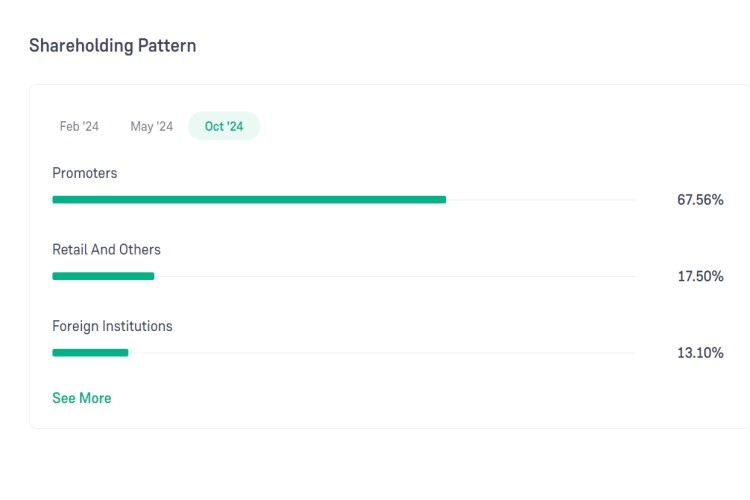

- FII Holding in the company is more than 13 %

- ROE is also more than 30 %

- Company Market cap is 886 crore

- Mutual funds and DII Holding is also good

Cons

- Till date company hasn’t deliver any big project.

- Company has high debtors

Garuda Construction Share Price Target 2024

| Year | Price |

| October 2024 | 95 to 105 |

| November 2024 | 108 to 115 |

| December 2024 | 117 to 122 |

Share target 2025, 2026, 2030 Garuda Construction

| Month | Price |

| January 2025 | 125 to 130 |

| February 2025 | 132 to 145 |

| March 2025 | 148 to 155 |

| April 2025 | 157 to 162 |

| May 2025 | 163 to 168 |

| June 2025 | 169 to 171 |

| July 2025 | 172 to 179 |

| August 2025 | 181 to 195 |

| September 2025 | 198 to 210 |

| October 2025 | 212 to 225 |

| November 2025 | 228 to 235 |

| December 2025 | 240 to 250 |

| Month | Price |

| 2025 | 125 to 250 |

| 2026 | 255 to 320 |

| 2027 | 330 to 440 |

| 2028 | 445 to 520 |

| 2029 | 520 to 570 |

| 2030 | 580 to 630 |

Garuda Construction Company ShareHolding Pattern

What I like about this stock is that it has many mutual funds and FII holdings. As per the research, promoter small-cap Mutual funds show interest in the company. In the next quarter if the company is able to gain a good project or profit then Upper can be seen.

Disclaimer:-

So before adding this stock to your portfolio, it is recommended that you advise to your Financial adviser.