Hyundai Motors Share Price Target, 2025, 2026, 2030:– This October, India’s biggest IPO was finally listed on the national stock exchange. This much-awaited IPO is worth more than 25,000 crores and offers 14.22 crore shares. To date, this is one of the biggest IPOs in the Indian stock market. Back in 2022, we saw that LIC and Coal India’s IPOs were also big. People who applied for this IPO and didn’t get the allotment also looking for the best time to invest. Talking about the company, Hyundai Motors India is currently the second largest car maker in India after Maruti Suzuki. The main thing that people want to know is what will be the price target of the company.

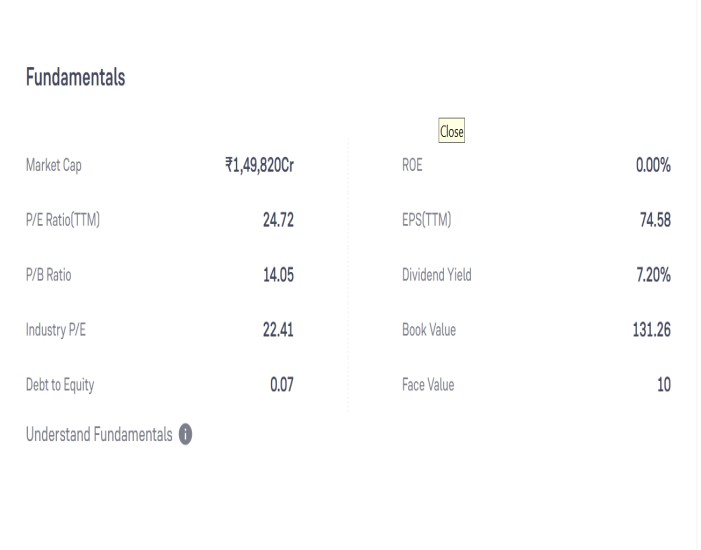

Hyundai Motors Fundamentals Analysis

The company came to India’s market back in 1996 with its first hatchback car Santo, The Company slowly increased it’s production capacity and set up its first plant in Tamil Nadu India. Hyundai’s current market cap in India is around 1,50,000 crore as of October 2024. If you check out the sale and profit growth then it is continuously increasing. The company is almost debt-free. the best part is that in the last three year Company returns on Equity is also impressive.

The current book value of Hyundai is 131 and the P.E ratio is 24.72. For Long-term investment, it is the right time as the company has high growth plans in the future, Before the IPO, Hyundai also confirmed that 3 Billion Dollar IPO amount would be used to set up another production unit.

Hyundai Motors India Share Price target 2025

The reason why Hyundai shares are unable to gain a good listing price is the Middle East war. Share Price in the year 2025 will likely increase, Market crash in October 2024 is the right time to pick up this stock. We have predicted a chart a show you how this stock may perform in 2025.

| Year | Share Price |

| January 2025 | 1950 to 2000 |

| February 2025 | 2030 to 2160 |

| March 2025 | 2180 to 2250 |

| April 2025 | 2280 to 3400 |

| May 2025 | 3450 to 3550 |

| April 2025 | 3560 to 3600 |

| May 2025 | 3610 to 3680 |

| June 2025 | 3700 to 3810 |

| July 2025 | 3830 to 3950 |

| August 2025 | 3970 to 4050 |

| September 2025 | 4100 to 4250 |

| October 2025 | 4270 to 4350 |

| November 2025 | 4380 to 4450 |

| December 2025 | 4480 to 5100 |

This is the current prediction of the company, In case the Company announces a bonus Price may Split and the shareholders get an additional share.

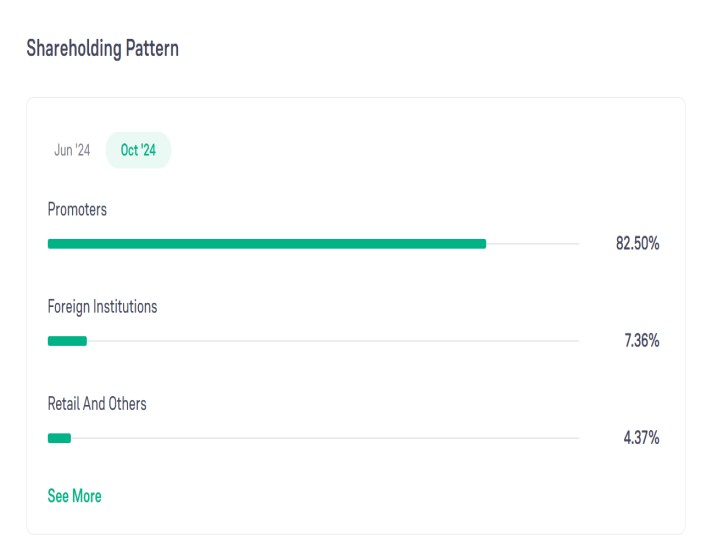

Hyundai Motors Share Holding Pattern

In October Promotors Held around 82.50 % of the company, Apart from this Foreign institution holding is also good i.e. 7.36. Mutual funds also show a good interest in the company as it is just launched. Retail investor holding in the company is just 4.37 % which is very low. Long-term Investor can put their money in small amounts and wait it to grow.

| Year | Share Price |

| 2026 | 5100 to 5900 |

| 2027 | 5900 to 6500 |

| 2029 | 6700 to 8000 |

| 2030 | 8100 to 9500 |

Hyundai Motors India Future Plan

To date, the Company has delivered excellent design, a good future, and performance in their cars. The company is now ready to enter in EV market. Two Major Indian companies Tata, and Mahindra already launched their EV models but now it’s time to Hyundai to accelerate the EV market.

- Research and Development Investment:- Currently the company has one R&D center in Hyderabad but as Future cars advance year by year so the company has more focus on, Auto driving and Battery technology. To make car More advanced and futuristic companies also want to add AI Technology to it.

2. EV Revolution: Hyundai plans to lead in Electric vehicles with new models and technology. Hyundai may plan to build its own third-party battery production unit to ensure the longevity of its cars. Lithium-ion batteries will be the future of in EV Segment and many car makers are currently focus on Good and affordable battery.

3. Hydrogen Fuel Technology: When we talk about Future technology, Hydrogen Fuel comes in mind. It is a technology in which Hydrogen is converted into electricity to generate Power in cars. Earlier this year In Budget Nitin Gadkari clear that Future car will be run on Ethanol and Green Hydrogen.

4. Heavy Duty Vehicle :-

To date the company hasn’t expanded it’s self in Heavy-duty vehicles but in the future they are Planning for EV-powered trucks and Bus. Ashok Leyland and Tata motors already entered in the market but in future Company may focus on this segment as well.

Is it Good to Invest in Hyundai Motors In India ?

A Major question that is coming in our mind is whether is it a good time to invest. Well, Companies that are just listed in the market attract investors if they have Good Plans. Hyundai is well Known International brand so the growth probability is also very high. 2025 surely be a good time to Invest in this stock, If you have a long-term goal then Don’t hesitate to Invest, However, we don’t strongly recommend any stock as you must consult your financial adviser First.