NTPC Green Chart & Target 2025:- NTPC Green India’s Biggest thermal power company, NTPC, finally announced that its subsidiary, NTPC Green, will be listed in November in the Indian stock market. This is the second biggest IPO of 2024 after Hyundai Motors. NTPC will raise more than 10,000 crore from this IPO. As the Renewable energy sector is rising in India, the company has good growth plans. A subscription rate can be seen on NSE official website during the IPO, On the first day IPO Subscribed over 33 %. Long terms investor wants to Know what will be the best time to Put the money. Well, It is estimated that More than 78 % of investors sell their stake within the first week of IPO after listing gain.

You can slowly add your 30 % investment after the listing. If the price falls 10 to 20 %, then you can easily average it. NTPC and its sub-dairy are all doing well in India and internationally. Before we Do some technical analysis let’s check it’s are the future Plans.

NTPC Renewable Energy Future Plans

As the name indicates this subsidiary will work In solar Power generation mainly, It is estimated that this will be the third largest solar Generation company after Adani & Tata power. Currently, it has a power generation capacity of about 3.3 GWK. it is estimated that 97 % of the power generation is with Solar panel and only 3 % will be of Wind power. Company has following Projects & Future Plans mentioned below.

- Solar Power

- Floating solar

- Wind Power

- Hybrid Power

- RE park

- Green Hydrogen

- Offshore Wind

The future of company power generation is currently at the next level. In South India companies has put more potential towards solar Projects. Floating solar panels may be the first time in India which will be used to produce energy. Indian govt aims to have zero carbon emissions by 2035 in India that’s why many Companies are moving towards Renewable energy.

Fundamentals & Technical analysis

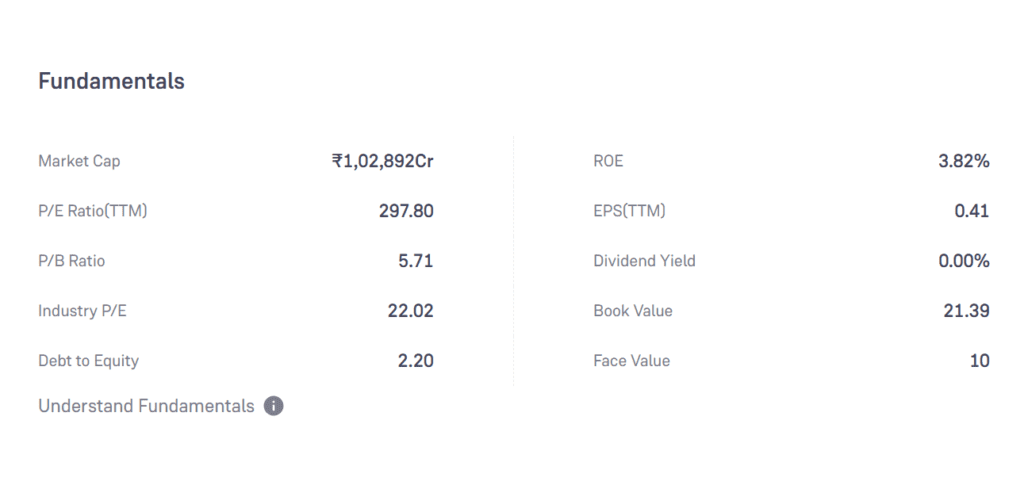

According to current reports, NTPC Green’s total market cap is 1,02,892 Crore, and its current return on equity is 3.82 %, which is a bit high. The company’s net profit in the year 2024 is 345 crore. As of November 2024, promoter holding in the company is about 89.01 %, Followed by 3.68 % retail, 3.52 % mutual funds, and 2.24 % foreign institutions. The PE Ratio is much higher i.e. 247.

NTPC Green Share Price Target 2025

| Year | Price |

| January 2025 | 120 to 125 |

| February 2025 | 126 to 132 |

| March 2025 | 133 to 140 |

| April 2025 | 142 to 150 |

| May 2025 | 151 to 163 |

| June 2025 | 164 to 172 |

| July 2025 | 173 to 182 |

| August 2025 | 183 to 198 |

| September 2025 | 199 to 213 |

| October 2025 | 215 to 225 |

| November 2025 | 226 to 235 |

| December 2025 | 238 to 248 |

NTPC Green Yearly Target 2026 to 2030

As the Indian Govt aims to lower carbon emissions in the next 15 years so company’s future seems very bright. In the last 4 years, many companies in the renewable energy sector gave a massive return to their shareholders. Waaree Renewable, Inox Wind, and Suzlon all are working In the renewable energy sector.

| Year | Price |

| 2026 | 250 to 380 |

| 2027 | 385 to 560 |

| 2028 | 565 to 710 |

| 2029 | 720 to 980 |

| 2030 | 990 to 1195 |

Is it Good to Invest in NTPC Green Energy

To see the current growth plan it is clear that the company’s vision is quite big for upcoming years. NTPC Green Chairperson clear that the company not just working on Solar energy but Battery storage & Green hydrogen will also be future. The company is continuously working to enhance its capacity in the upcoming years.

Those who are picking renewable energy stocks surely Pick NTPC Green and add in the portfolio. For all the latest updates about the Share market stay in touch with our homepage.